crypto tax calculator australia

Sign up for our free trial get a feel for the application then send us an email to get started in calculating your clients. Send everything you have to us we import it all and help identify issues and walk you through the data.

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Bitcoin

The main one that accountants and clients are usually after is the Capital Gains Report and the Income Report but we do provide other reports according to what you need.

. How can Crypto Tax Calculator Australia help me with crypto taxes. To lodge a tax return for the current tax year you will have to submit it before October 31st 2022. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes.

Thats just over 4 a month for your peace of mind when it comes to crypto tax in Australia. You just need to import your transaction history and we will help you calculate your realised capital gains and current holdings. You can then send this to your accountant or tax agent.

Each tax report can be downloaded both as a PDF and as a CSV file. Crypto Tax Calculator Australia is here to help. Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800.

If you hold for a year youll pay 50 less capital gains tax on crypto gains. Discover how much taxes you may owe in 2021. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Link trades using FIFO LIFO HCFO or a custom method. You can generate the reports as many times as youd like as. Carrying on a business of trading crypto assets is very difficult to define as it is for share trading activities.

Our crypto tax calculator plans can cost less per year then a subscription to a streaming service. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. The tax rate on this particular bracket is 325.

It is possible to hold some assets as an investor and others. The 2022 financial year is fast drawing to a close. It has full integration with popular Australian exchanges.

The world of cryptocurrency and taxation is a murky one. Crypto tax platforms can help in ways to calculate your capital gains track Bitcoin prices at specific datestimes for personal income tax returns and company transaction reporting. Their plans start at only 50 per year on a subscription basis.

Crypto Tax Calculator Australia prides itself on making it simple and easy for you the customer to use our top of the range service and application when it comes to calculating your cryptocurrency tax. View Trading ProfitLoss as a Business. Its possible that the 225 billion in Friday expiration of Bitcoin options proves that bitcoins bottom wasnt at 17600.

The Australian Tax year will be operating between 1st July 2021 - 30th June 2022. Crypto Tax Calculator. For more information on visit the blog of Crypto Tax Calculator.

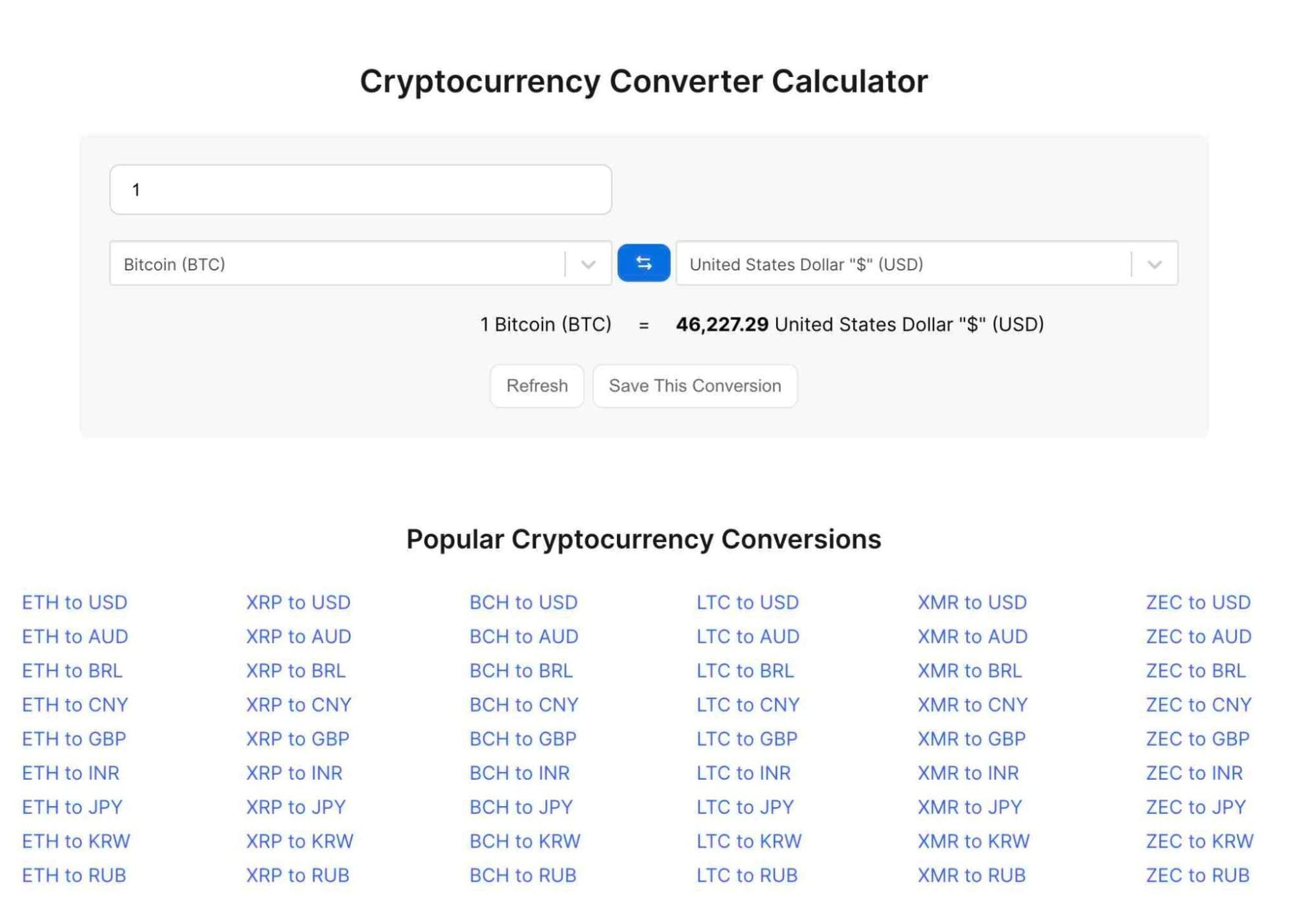

If youve sold traded or earned. You simply import all your transaction history and export your report. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year.

We review your data. View your taxes free. Were here to help you.

At Crypto Tax Calculator Australia we believe plans and pricing should be affordable no matter how much you are trading or the amount of transactions you have completed previously. Calculate your Crypto Taxes in Minutes Supports 300 exchanges ᐉ Coinbase Coinspot Coinjar Compliant with Aus. The Australian Tax Office has sent out letters to thousands of crypto traders in the last few months.

0325 5000 1625. Well Crypto Tax Calculator Australias plans and pricing are extremely affordable and versatile so you can choose the plan that works best for you based on your trading history. If you are one of the unlucky ones then the task of getting your transaction history.

You can discuss tax scenarios with your accountant. In Australia youll pay Capital Gains Tax and Income Tax on your crypto investment. Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly.

23 hours agoCrypto investors take note. We use this to. Read The Ultimate Crypto Tax Guide.

A record of all crypto purchases sales and interest earned. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. Janes estimated capital gains tax on her crypto asset sale is 1625.

Reporting your crypto tax activity. Here is a list of things you need before you lodge your crypto tax return with Etax. Export your data in an accountant-friendly CSV.

Ideally you should download a crypto tax report from your provider. We have 8 different types of tax reports. Many traders seek specialist advice or sometime ATO private binding rulings to ensure their activities are enough to constitute a business for tax purposes.

As an accountant whether you see crypto clients on a regular basis or once in a blue moon Crypto Tax Calculator Australia is here for all your crypto tax needs. Get help with your crypto tax reports. ATO Tax Reports in Under 10 mins.

Are you prepared for tax season. Koinly or Crypto Tax Calculator This report shows your profitloss and capital gains for the financial year. Welcome to the best crypto tax calculator application in Australia.

The percentage of Capital Gains Tax youll pay is the same as your personal Income Tax rate starting only from earnings above 18201. This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on. And the Australian Tax Office ATO is well aware that ever more Australians bought and sold Bitcoin CRYPTO.

It can be a difficult process to manually calculate the taxes accrued from your crypto transactions and the entire. Australian Tax Office Targets Cryptocurrency Investors With 350000 Warning Notices. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income.

Calculate Your Crypto Taxes With Ease Koinly

How To Calculate Crypto Taxes Koinly

Calculate Your Crypto Taxes With Ease Koinly

Cryptocurrency Tax Guides Help Koinly

Free Investment Property Calculator Excel Spreadsheet Investment Property Spreadsheet Template Excel Spreadsheets

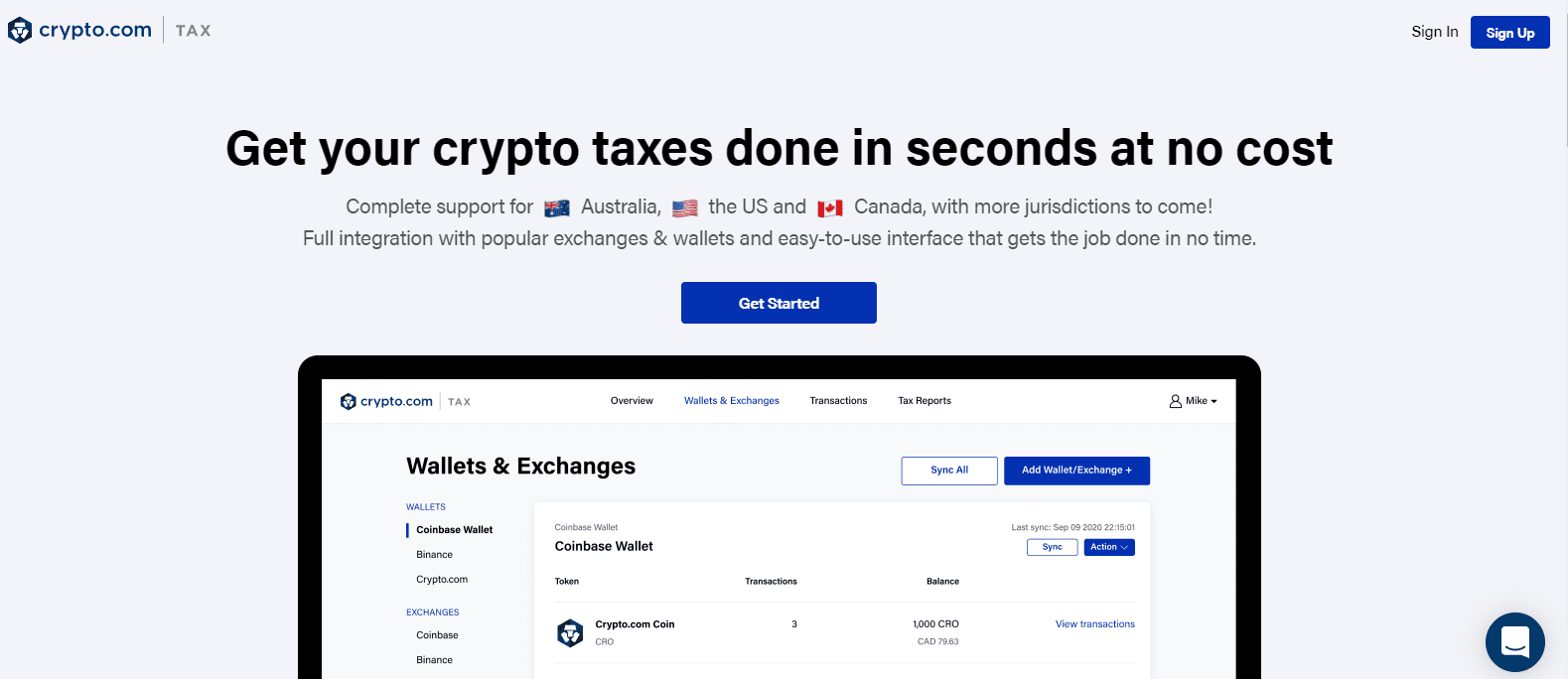

Best Crypto Tax Software Top Solutions For 2022

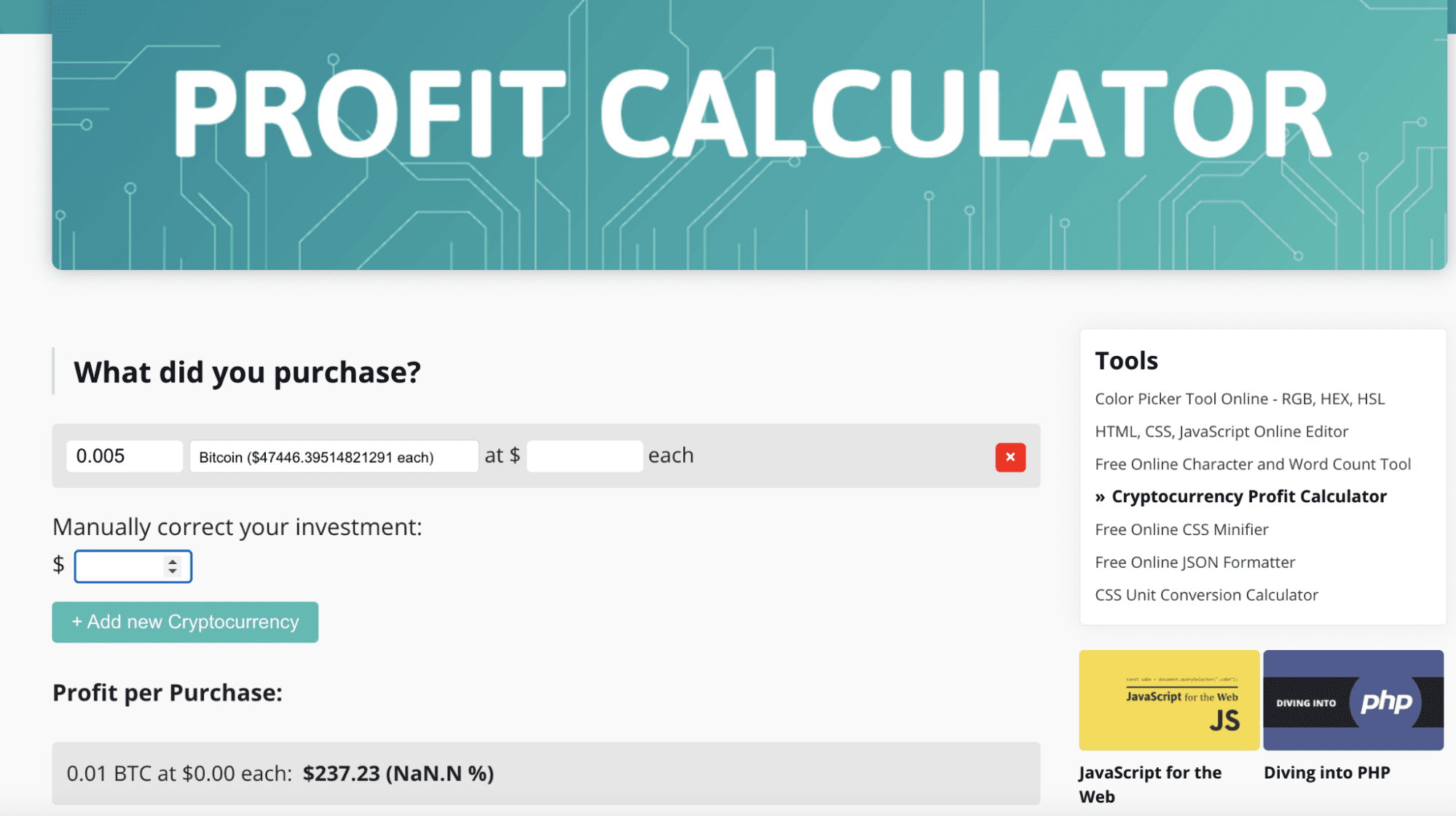

Crypto Profit Calculator Cryptocurrency Profit Estimator

Malta Based Stasis Launches New Euro Backed Stablecoin Euro Bitcoin Bitcoin Price

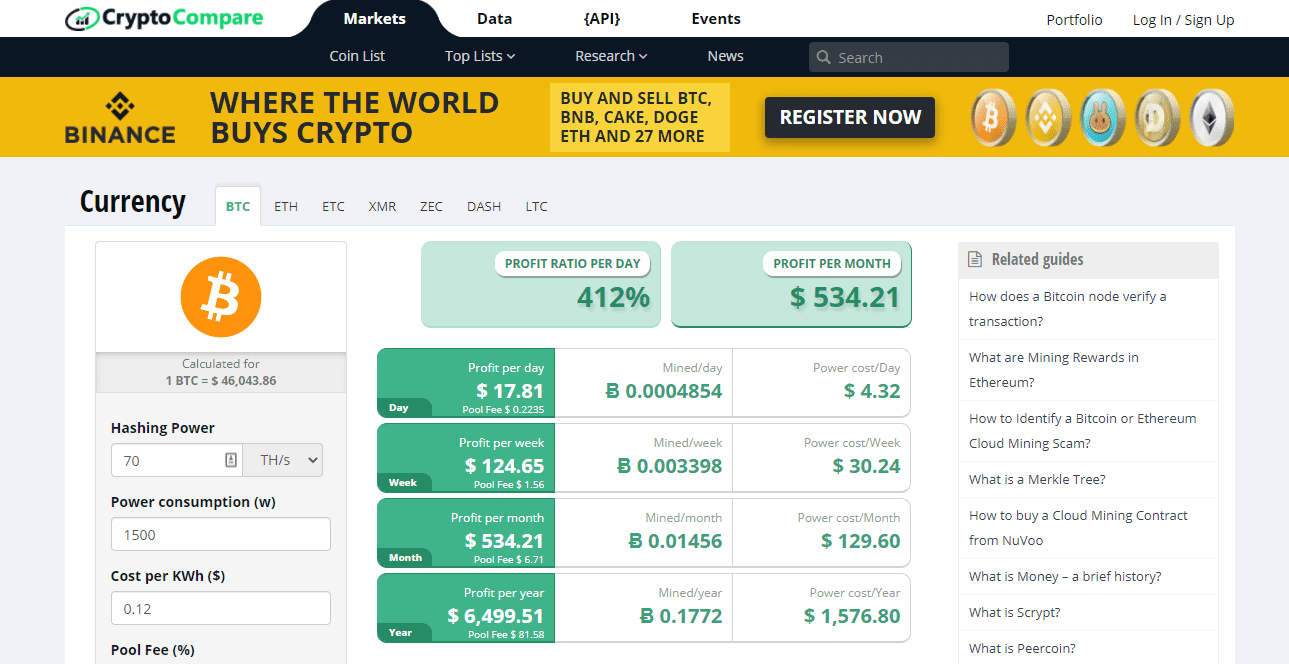

Best Cryptocurrency Calculator Mining Profit Taxes

Best Cryptocurrency Calculator Mining Profit Taxes

Best Cryptocurrency Calculator Mining Profit Taxes